The Shadow Treasurer and his advisors seem to think they are on a winner by suggesting that government spending is preventing the RBA from cutting interest rates.

Ted O’Brien asked Chalmers: “The RBA ‘s forecast shows that if it were to offer any further rate relief, inflation would not get back to the 2.5% target. Noting the National accounts show Government consumption still growing faster than household consumption, will the Treasurer admit, that with his foot on the accelerator and the governors on the break, he is making it impossible for the RBA to offer further relief?”

A couple things.

The RBA forecasts do no such thing. The Statement on Monetary Policy includes the assumption that the cash rate will fall to 3.3% by December next year (so basically one cut from the current. 3.6%). And the RBA also estimates that by December next year the trimmed mean inflation level will be 2.7%. That is within the 2% to 3% target range that is the RBA’s target. The RBA only “targets” 2.5% because that is the midpoint and so it is a natural place to aim – but the actual goal is just to be consistently between 2% to 3%.

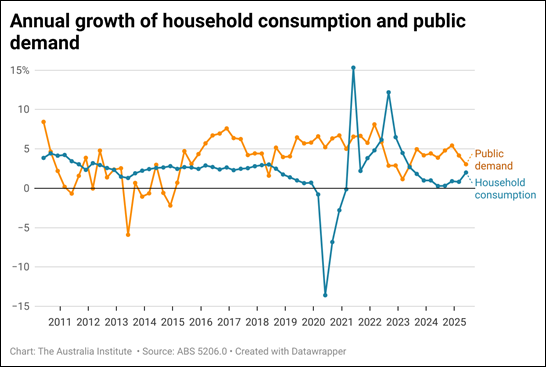

Then we get to government spending. The way to measure this is the growth of public demand – because that is the amount of extra demand the government is putting into the economy.

Yes, it is currently higher than household consumption growth, but that is because household consumption growth is SO DAMN LOW!!

When households are not growing their spending, the best thing a government can do is help provide some stimulus to the economy. That is what the governments have always done. And incidentally it is what the previous LNP government:

From 2015-2020 when household spending growth was as low as it is now, public demand helped keep things from falling over – and guess what, during this time interest rates were still cut!

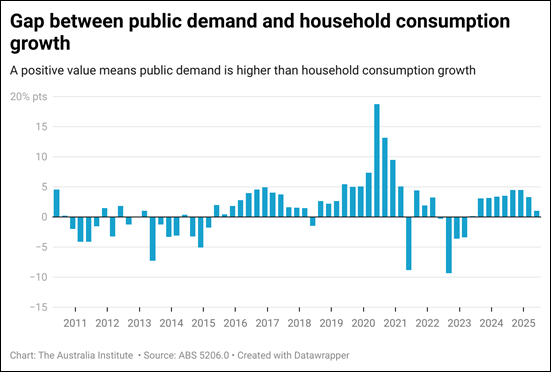

One way to look at the amount of extra impetus the public spending is giving is to compare it to household consumption growth.

As you can see through 2024 public demand was above household consumption but the most recent figures show, the gap has dropped considerably.

So the suggestion that the government is preventing further rates cuts is pretty spurious. And given GDOP is projected to grow at just a mere 2%, an argument could be made that there should be more government spending to keep the economy going.

No comments yet

Be the first to comment on this post.