As we know at 2:30 this afternoon the Reserve Bank will announce that it has kept interest rate on hold.

The more interesting thing will be its release of the November Statement on Monetary Policy. This is a statement the RBA puts out every three months and contains a summary of what is going on around the world and here in Australia as well as its forecasts for the next couple years.

So, we’ll be giving you the info on that as soon as it comes out.

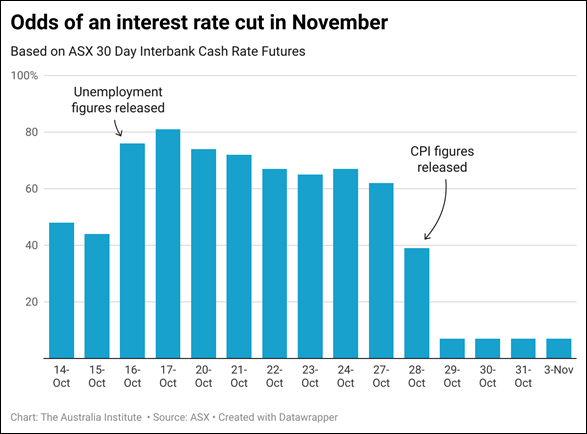

What is also interesting is how the market has changed its expectations of a rate cut.

On 15 October, the day before the September unemployment figures came out showing a rate of 4.5%, the market rated it about a 44% chance that the RBA would cut rates today. After the unemployment figures came out it jumped to a 76% chance.

As the days went on though, investors likely remembered the RBA hates cutting rates, and so the odds drifted down a bit. But then the September CPI figures were released and the chances sunk like a stone – down to 39% and then 7%.

It highlights that the market (and the RBA to be honest) gets more spooked by a surprise inflation figure than a surprise unemployment rate – and that the RBA will do everything it can to keep inflation below 3% and very little to keep unemployment from going above 4.5% (and nothing at all to stop it going above 4%)

1 Comment

I made this comment yesterday, but it was knocked back for some reason - I'll try again.

Greg,

did the RBA raise interest rates unnecessarily high during 2022/23/24?

I'm no economist, but from what I've read it would seem that interest rates were very low, and arguably kept too low to suit Josh Frydenberg's obsession with getting a surplus, during the Morrison government. So, some kind of adjustment was wise.

However, the inflation we experienced was initially due to supply chain disruption caused by the Covid pandemic, and a massive jump in oil and gas prices caused by the war in Ukraine and the sanctions placed on Russia - it was not demand-driven inflation. As things progressed it was profit-driven inflation, but not wages-driven.

Was it necessary for the RBA to drag massive amounts of money out of circulation in the economy by raising interest rates by that much? I can see that too much money chasing limited goods would create inflation no matter the reason for the limited goods, but inflation came down worldwide as the supply chains were restored and the USA replaced Russian gas, whether for that reason I can't say. So, could Australia have weathered that inflationary period without inflicting so much financial stress on so many by raising interest rates so high?