See you next year?

And that is it. We are done for the parliamentary year.

And what a year it has been – an election, the demise of the Coalition, a new website and blog – but the same old Albanese government.

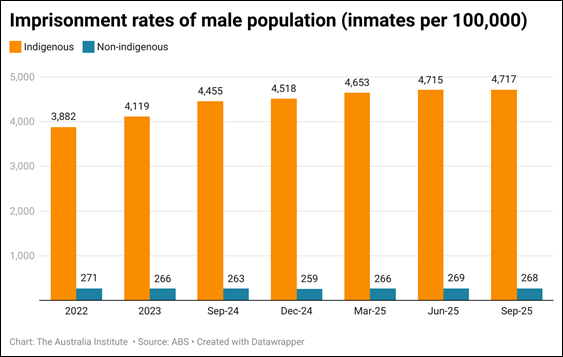

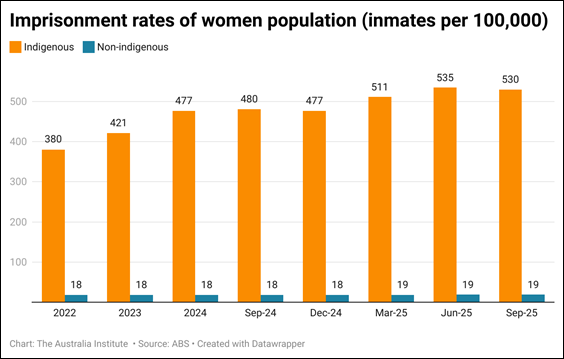

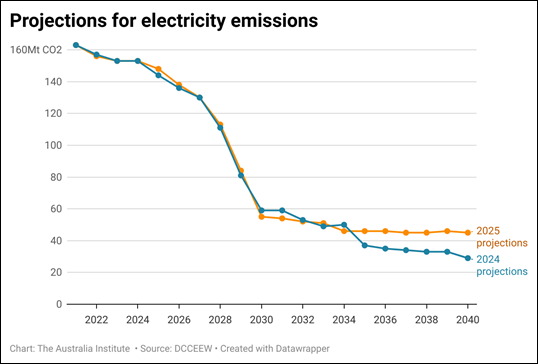

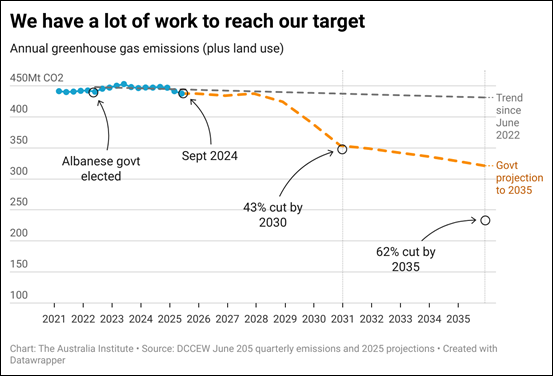

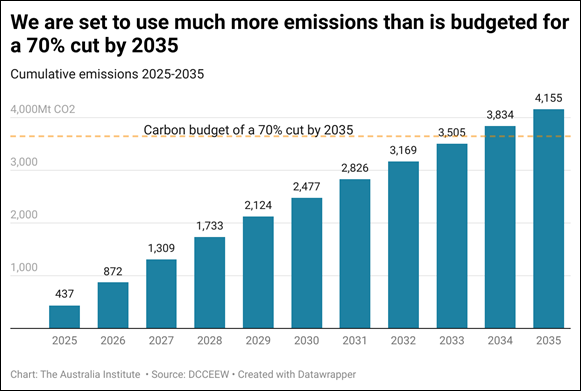

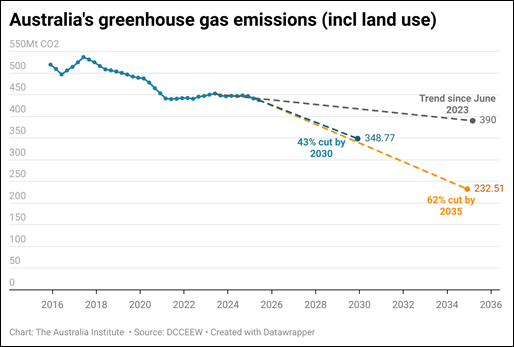

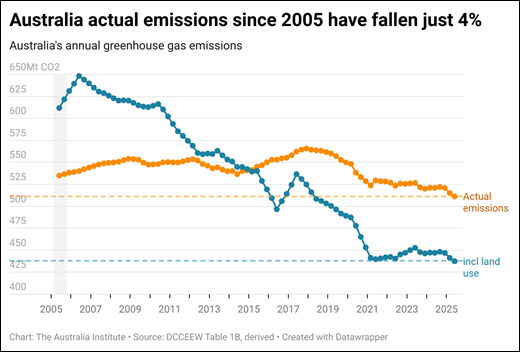

Will we see some bravery and reforms which work to address widening inequality, our emissions and the climate at large?

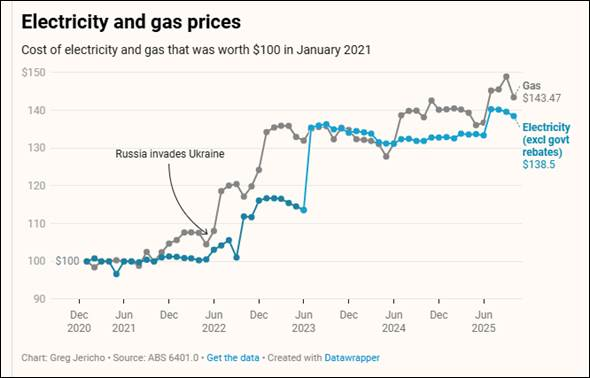

We have to hope so. It has been a rough year for a lot of people and there has been a lot of disappointment from people who were hoping for something better. That is completely fair and I think people should have as much space as they need to express that.

But there is a growing number of people – all over the place – who are turning that disappointment into action. The government can’t fool people like it might have once done. And it can’t count on having everyone who voted for it continue to vote for it. That doesn’t mean the Coalition will benefit, but there is room – and it seems, the determination – for a new politics to start emerging, where the two party stranglehold over policy is cracked.

Next year is the year Labor has to do anything it plans on doing – the year after that is election mode, and things rarely get done in election mode. So make sure you rest over the break because there is a big year coming – and you matter.

But that’s for next year. For right now – thank you. Thank you to the team at The Point and The Australia Institute – it’s a small team, but a mighty one. Thank you to our contributors and the researchers who take time out of their very busy days to explain the world a little better to you. Thank you to Mike Bowers – I could not do it without him. He is a super star and I am very lucky to have him walk the hallways with me.

But mostly, thank you to you dear reader. This little project was born out of a desire to see if we could do political journalism a little better, and a little bolder. To call a lie a lie, and reflect what was actually happening and not pretend facts don’t matter, or objectivity means running bullshit.

We want to explain what is behind the policies, and what isn’t being talked about, as well as what is and why – and have a bit of fun doing it. And that so many of you have joined us is honestly incredible. We don’t take your trust for granted and we will continue to build this blog with you in mind. You are all wonderful.

So have a break this summer. Have some fun. We’ll still be here when you get back. And the work continues even while the blog rests.

I hope you all have a loved filled holiday season and get some time to do what brings you joy.

Until February 3 when parliament, and The Point Live team returns – take care of you Ax

Comments

Start the conversation