Grog’s has written on the tax system for the Guardian this week (you can find the whole column, here)

Last Friday two news reports perfectly encapsulated why people might feel the economy is rigged against them. First, the ATO released the corporate tax transparency report showing that 28% of companies with annual turnover above $100m paid no tax on their income here. Then came a report by Jonathan Barrett on the impact of the ATO’s new initiative of clawing back old tax debts.

The political reality is if we want a better, more equal society, the government needs to raise more tax to pay for better public services and benefits. But more tax only works if the system is also fair.

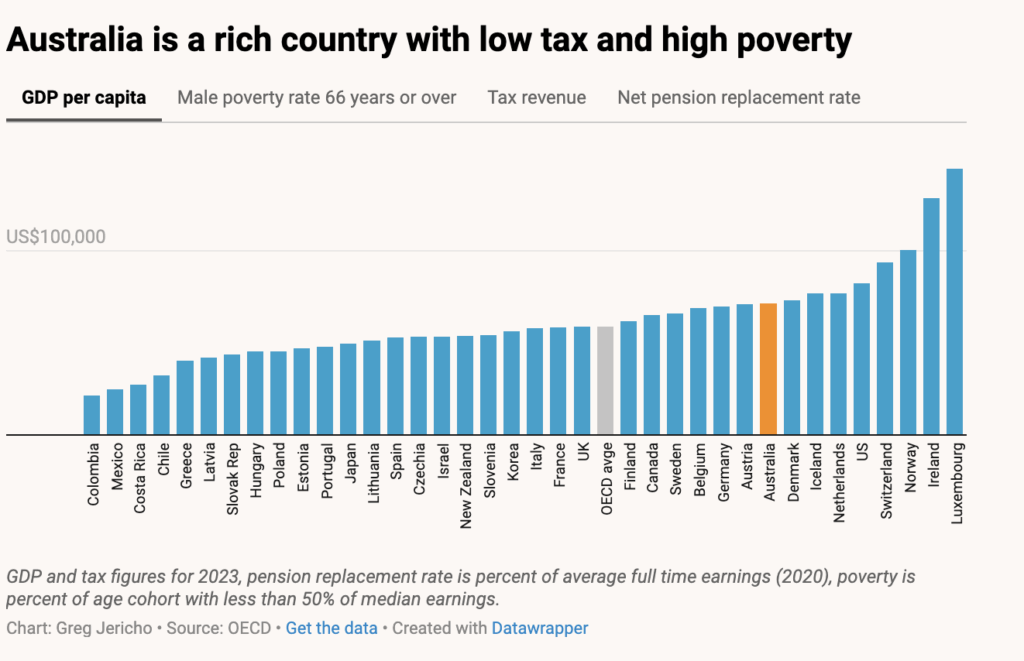

As I have said many, many times before, Australia is a very low taxing nation – and this is not without consequences.

It’s not a fluke that Australia is the ninth-richest country in the OECD, but has the fifth-worst rate of poverty among women aged 66 or older (and seventh-worst among men) – we have the worst rate of aged pension for women and the second-worst rates of male aged pension. And not surprisingly Australia raised the 10th-least amount of tax:

No comments yet

Be the first to comment on this post.