Ahead of today’s RBA decision the market says there is about a 10% chance of a cut. So it is likely they won’t because usually the RBA doesn’t do surprising things (probably because if you do the thing most people expected you to do it gives you cover to justify doing it).

But should the RBA cut rates? Of course they should!

Three reasons.

- Inflation is under control.

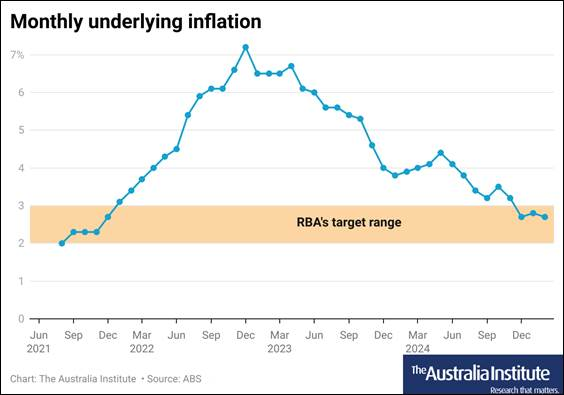

The RBA consistently says it wants to see “underlying inflation” consistently within its 2% to 3% band. Underlying inflation is nothing special – it’s just inflation that cuts out the biggest 15% rises and biggest 15% falls in prices – so it gets “the middle” 70%.

So how is that going? Well the monthly inflation measure that came out last week showed that underlying inflation has been trending down and has also been below 3% for 3 straight months

- Unemployment

The RBA’s job is not to just worry about inflation but also “contribute to the stability of the currency, [this is economic speak for inflation] full employment, and the economic prosperity and welfare of the Australian people.”

So how in unemployment going? Well, it’s ok. Holding up around 4.0%, and underemployment is also doing ok. But the RBA has kept thinking that “full employment” is actually 4.5% unemployment. Because it thinks we need that many people out of a job and living in poverty to keep inflation from rising. Well unemployment has been below 4.5% for 3 years and 3 months and in that time, inflation went up and then down. Unemployment is currently 4.1% and guess what – inflation is not rising! The RBA should be doing all it can to keep unemployment from rising and a rate cut would do that, with little risk to inflation.

- Welfare of the Australian people

So about that last bit of what the RBA needs to care about. Well the rate cates have caused at least half of the rise in cost-of-living for anyone paying a mortgage, and have also helped make sure rents have gone up as landlords used the rate rises as an excuse (even though they get to deduct mortgage costs – you know, negative gearing!). So a rate cut would definitely help improve our welfare. Also how is our welfare right now? Well a good guide is are we spending in a way that suggests we are happy and feeling good? Nope. In 2024 we bought less stuff per capita (ie per person) than we did a year earlier.

Once you take into account inflation, on average every Australian bought $3,849 worth of stuff in the shops in the last 3 months of 2024, compared to $3,883 worth of stuff in the last 3 months of 2023. That is not good – we should be buying more each year because we should have more money to spend!

Why aren’t we? Well if you have a mortgage you know why…

No comments yet

Be the first to comment on this post.