The Greens call for to grandfather negative gearing and the 50% CGT discount to one investment property and to scrap the 50% capital gains tax discount for all other assets echoes our call in our “Raising Revenue Right” report.

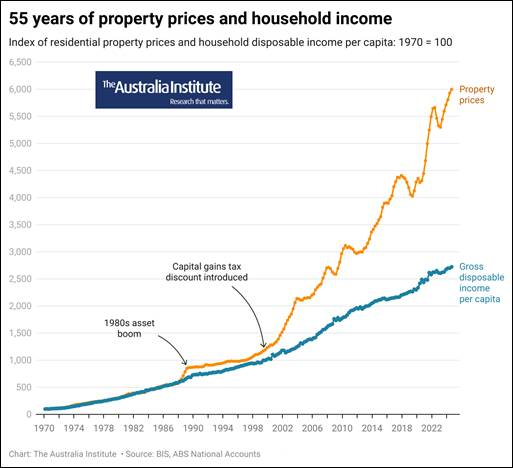

It is pretty clear that the John Howard/Peter Costello introduction of a 50% capital gains tax discount turned the housing market into a speculators’ dream that benefited investors. It destroyed housing affordability. Before the discount came into being property prices usually went up in line with household income. The only time it didn’t was during the 1980s boom where asset prices soared at unsustainable rates … and then everything went to hell in the 1990 recession. But even that was nothing compared to what has happened over the past 25 years

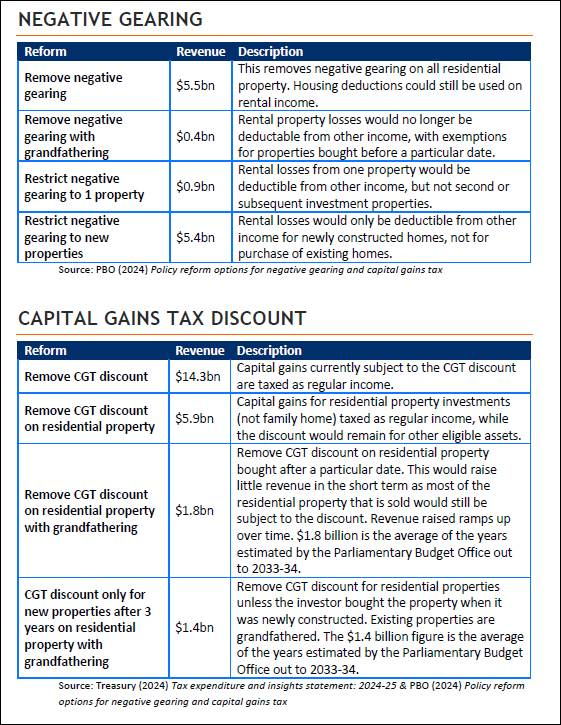

So getting rid of the CGT discount is a smart idea. And grandfathering it for 1 property is politically smart because around 72% of all negative gearers only have 1 property.

Bandt will no doubt have figures on how much these changes would raise but in our report we had some estimates for how much a variety of changes would raise.

Given both the ALP and LNP are essentially doing bugger all on hosing in this election other either blaming international students or talking about some small increases in supply from the Housing Australian Future Fund, it’s good that there will at least be some discussion of the biggest problem.

No comments yet

Be the first to comment on this post.