Greg Jericho

Chief economist

At some point in every electoral campaign that is going badly, the leader reaches for the idiocy switch and starts predicting horrors should the other side be elected.

In 1983, Malcolm Fraser told reporters that were a Labor government be elected, “people would be better off keeping their money under the bed”. It pretty much alerted everyone to the fact that Fraser was lost to rationality and so too were his election hopes.

Well today Peter Dutton decided to step up to the plate and take his place in Australian electoral idiocy by claiming that there would be a recession “under Labor” and that the reason the Treasurer Jim Chalmers was saying that the market is now anticipating a 50 basis points rate cut in May is because “he’s telling Australians that there are difficult times ahead under Labor. That’s exactly what he’s doing.”

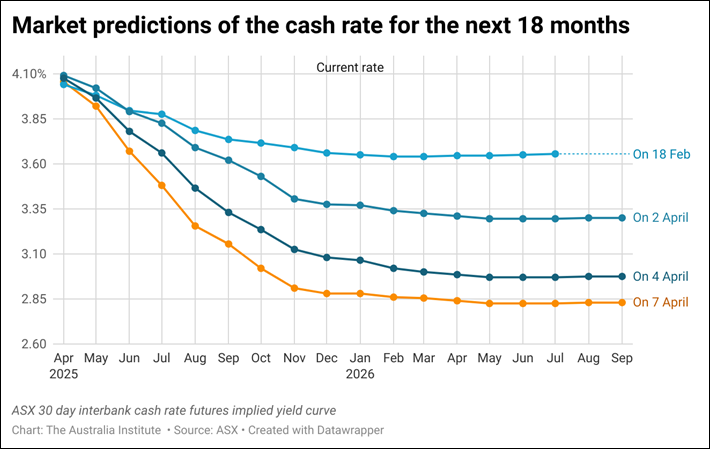

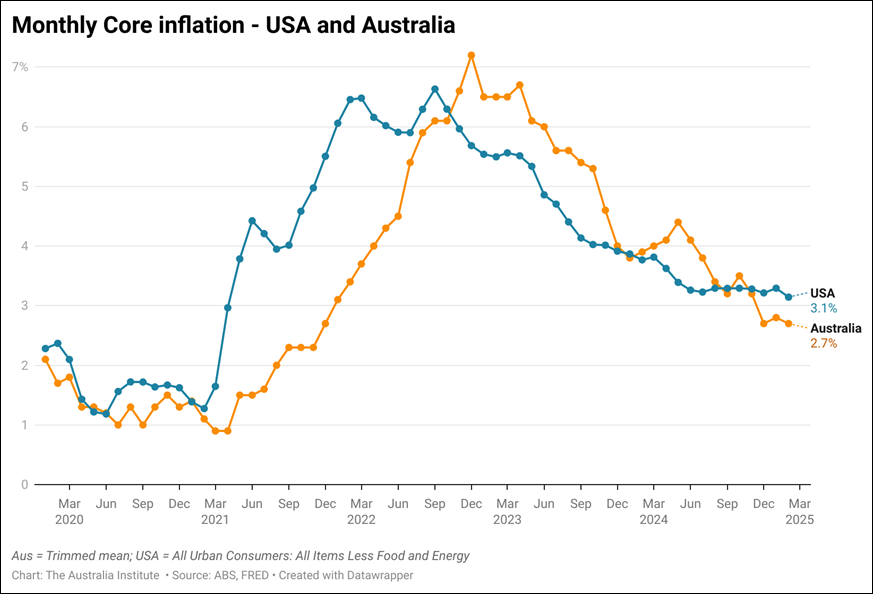

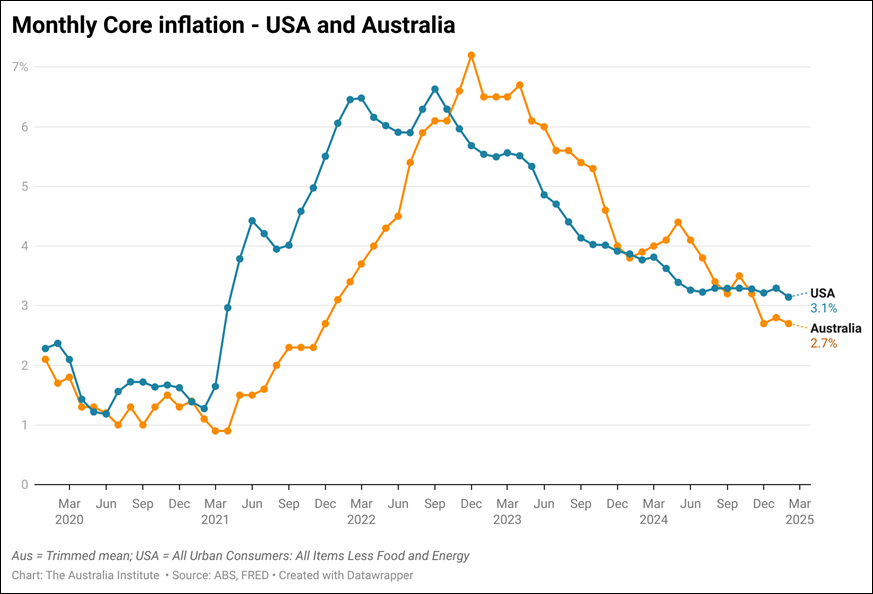

Every sentient being knows that the reason we now are likely to have a stack of rates cuts (possibly 5 by the end of the year) is because of Donald Trump raising tariffs everywhere and freaking everyone out that there might be a GLOBAL recession coming.

Dutton trying to blame the ALP for a GLOBAL slowdown is beyond stupid. Stupid economically – because clearly it is wrong; and stupid politically, because everyone – even those who do not understand economics – know it is wrong.

Everyone knows what Trump is doing is hurting the world economy. Dutton seems rather unhinged because Australia did not get higher tariffs than other countries such as the UK or New Zealand, and his hopes of being able to spend the 5 weeks talking about high interest rates are now dissolved before his eyes.

But even still, political leaders should not be going around saying a recession is coming – the last thing any leader should do is be saying things that might have people thinking they should panic. And recessions are very much panic stations events. It’s why serous politicians never suggest they are coming.

Anthony Albanese when asked much the same question only had to say of the opposition that “I’m absolutely certain this is not the time to cut. This is not the time for what the coalition are going to have to do to pay for their $600 billion of nuclear power plants as we go forward. Now is the time to

continue to manage the economy responsibly whilst we make sure we build Australia’s future by building up our education system.”

He might be trying to draw your attention to what the LNP’s policies might be, but he’s not saying under Dutton we will have a recession.

But here’s the other point – the real issue is what would the ALP or LNP do if the global economy does slow due to Trump.

Peter Dutton, in between blaming Labor said he would respond “As a Coalition I will always and Angus will always adhere to the principles of a Coalition government. That is to live within our means and make sure we can provide support to families and make sure we’re not continuing to build on the pressure that families are under by pushing prices up all the time.”

Ok, but in a recession, prices are not going up all the time, and living within your means is not possible unless you think austerity is the way to go. Is that what he is saying?

Back during the Global Financial Criss, the then Rudd Govt undertook a massive stimulus plan to keep Australia out of a recession. It worked. It’s why we refer to it as the GFC and everywhere else it is called The Great Recession.

So what was Peter Dutton saying back in 2009 that might give us a sense of his “principles of a Coalition government”?

In parliament on the stimulus bill, Peter Dutton said “today is the day that the Labor Party put into debt the future generation of Australian children.” And he further argued that “This government has taken a reckless course.”

It would seem Peter Dutton would therefore be unlikely or hesitant to deliver appropriate support should the rest of the world go under – preferring instead – as he said in 2009 to treat the budget like a household budget and “to consider whether, if it were their own household budget, they would plunge themselves into considerable debt”.

These questions should be front and centre of the campaign. Because if your policy is austerity, Australians need to know now.

And finally, back in 1983 Bob Hawke responded to the line that Australians would hide their money under theirs beds by responding with contempt and mirth, “But you can’t put your money under the bed… that’s where the commies are.”

In tonight’s debate I doubt Albanese will have such a witty rejoinder, but he will not doubt be taking Dutton to task for speaking of a recession.

Comments

Start the conversation